THE NEW YORK TIMES

August 9, 2009

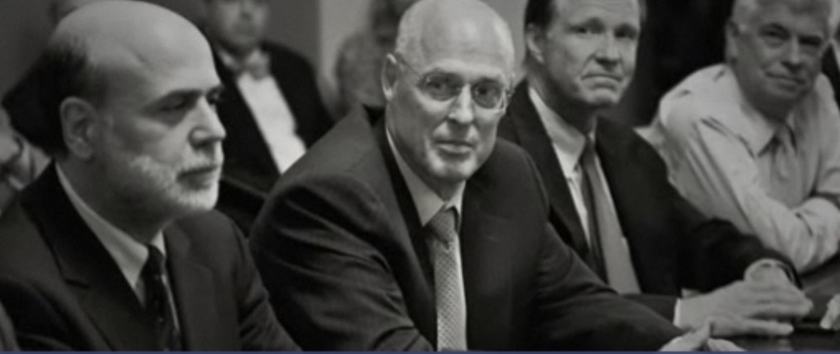

Paulson’s Calls to Goldman Tested Ethics

Before he became President George W. Bush’s Treasury secretary in 2006, Henry M. Paulson Jr. agreed to hold himself to a higher ethical standard than his predecessors. He not only sold all his holdings in Goldman Sachs, the investment bank he had run, but also specifically said that he would avoid any substantive interaction with Goldman executives for his entire term unless he first obtained an ethics waiver from the government.

But today, seven months after Mr. Paulson left office, questions are still being asked about his part in decisions last fall to prop up the teetering financial system with tens of billions of taxpayer dollars, including aid that directly benefited his former firm. Testifying on Capitol Hill last month, he was grilled about his relationship with Goldman.

“Is it possible that there’s so much conflict of interest here that all you folks don’t even realize that you’re helping people that you’re associated with?” Representative Cliff Stearns, Republican of Florida, asked Mr. Paulson at the July 16 hearing.

“I operated very consistently within the ethic guidelines I had as secretary of the Treasury,” Mr. Paulson responded, adding that he asked for an ethics waiver for his interactions with his old firm “when it became clear that we had some very significant issues with Goldman Sachs.”

Mr. Paulson did not say when he received a waiver, but copies of two waivers he received — from the White House counsel’s office and the Treasury Department — show they were issued on the afternoon of Sept. 17, 2008.

That date was in the middle of the most perilous week of the financial crisis and a day after the government agreed to lend $85 billion to the American International Group, which used the money to pay off Goldman and other big banks that were financially threatened by A.I.G.’s potential collapse.

It is common, of course, for regulators to be in contact with market participants to gather valuable industry intelligence, and financial regulators had to scramble very quickly last fall to address an unprecedented crisis. In those circumstances it would have been difficult for anyone to follow routine guidelines.

While Mr. Paulson spoke to many Wall Street executives during that period, he was in very frequent contact with Lloyd C. Blankfein, Goldman’s chief executive, according to a copy of Mr. Paulson’s calendars acquired by The New York Times through a Freedom of Information Act request.

During the week of the A.I.G. bailout alone, Mr. Paulson and Mr. Blankfein spoke two dozen times, the calendars show, far more frequently than Mr. Paulson did with other Wall Street executives.

On Sept. 17, the day Mr. Paulson secured his waivers, he and Mr. Blankfein spoke five times. Two of the calls occurred before Mr. Paulson’s waivers were granted.

Michele Davis, a spokeswoman for Mr. Paulson, said that the former Treasury secretary was busy writing his memoirs and that his publisher had barred him from granting interviews until his manuscript was done. She pointed out that the ethics agreement Mr. Paulson agreed to when he joined the Treasury did not prevent him from talking to Goldman executives like Mr. Blankfein in order to keep abreast of market developments.

Ms. Davis also said that Federal Reserve officials, not Mr. Paulson, played the lead role in shaping and financing the A.I.G. bailout.

But Mr. Paulson was closely involved in decisions to rescue A.I.G., according to two senior government officials who requested anonymity because the negotiations were supposed to be confidential.

And government ethics specialists say that the timing of Mr. Paulson’s waivers, and the circumstances surrounding it, are troubling.

“I think that when you have a person in a high government position who has been with one of the major financial institutions, things like this have to happen more publicly and they have to happen more in the normal course of business rather than privately, quietly and on the fly,” said Peter Bienstock, the former executive director of the New York State Commission on Government Integrity and a partner at the law firm of Cohen Hennessey Bienstock & Rabin.

He went on: “If it can happen on a phone call and can happen without public scrutiny, it destroys the standard because then anything can happen in that fashion and any waiver can happen.”

Inevitable Questions

Concerns about potential conflicts of interest were perhaps inevitable during this financial crisis, the worst since the Great Depression. In the weeks before Mr. Paulson obtained the waivers, Treasury lawyers raised questions about whether he had conflicts of interest, a senior government official said.

Indeed, Mr. Paulson helped decide the fates of a variety of financial companies, including two longtime Goldman rivals, Bear Stearns and Lehman Brothers, before his ethics waivers were granted. Ad hoc actions taken by Mr. Paulson and officials at the Federal Reserve, like letting Lehman fail and compensating A.I.G.’s trading partners, continue to confound some market participants and members of Congress.

“I think it’s clear he had a conflict of interest,” Mr. Stearns, the congressman, said in an interview. “He was covering himself with this waiver because he knew he had a conflict of interest with his telephone calls and with his actions. Even though he had no money in Goldman, he had a vested interest in Goldman’s success, in terms of his own reputation and historical perspective.”

Adding to questions about Mr. Paulson’s role, critics say, is the fact that Goldman Sachs was among a group of banks that received substantial government assistance during the turmoil. Goldman not only received $13 billion in taxpayer money as a result of the A.I.G. bailout, but also was given permission at the height of the crisis to convert from an investment firm to a national bank, giving it easier access to federal financing in the event it came under greater financial pressure.

Goldman also won federal debt guarantees and received $10 billion under the Troubled Asset Relief Program. It benefited further when the Securities and Exchange Commission suddenly changed its rules governing stock trading, barring investors from being able to bet against Goldman’s shares by selling them short.

Now that the company’s crisis has passed, Goldman has rebounded more markedly than its rivals. It has paid back the $10 billion in government assistance, with interest, and exited the federal debt guarantee program. It recently reported second-quarter profit of $3.44 billion, putting its employees on track to earn record bonuses this year: about $700,000 each, on average.

Ms. Davis, the spokeswoman for Mr. Paulson, said Goldman never received special treatment from the Treasury. Mr. Paulson’s calendars do not disclose any details about his conversations with Mr. Blankfein, and Ms. Davis said Mr. Paulson always maintained a proper regulatory distance from his old firm.

A spokesman for Goldman, Lucas van Praag, said: “Lloyd Blankfein, like the C.E.O.’s of other major financial institutions, received calls from, and made calls to, Treasury to provide a market perspective on conditions and events as they were unfolding. Given what was happening in the world, it would have been shocking if such conversations hadn’t taken place.”

Although federal officials were concerned that Goldman Sachs might collapse that week, Mr. van Praag said the only topics of discussion between Mr. Blankfein and Mr. Paulson at the time involved Lehman Brothers’ troubled London operations and “disarray in the money markets.” Mr. van Praag said Goldman was fully insulated from financial fallout related to a possible A.I.G. collapse in mid-September of last year.

However, Mr. Paulson believed he needed to request the ethics waivers during that tumultuous week, after regulators had become concerned that the same crisis of confidence that felled Bear Stearns and Lehman might spread to the remaining investment banks, including Goldman Sachs.

At a conference call scheduled for 3 p.m. on Sept. 17, 2008, Fed officials intended to discuss the financial soundness of Goldman Sachs, Merrill Lynch and Morgan Stanley, and they had asked Mr. Paulson to participate, according to Mr. Paulson’s calendars and his spokeswoman.

That was the first time during the crisis that Mr. Paulson’s involvement required a waiver, Ms. Davis said. The waiver was requested that morning and granted orally that afternoon, just before the 3 p.m. conference call.

A few minutes later, in an e-mail message to Mr. Paulson, Bernard J. Knight Jr., assistant general counsel at the Treasury, outlined the agency’s rationale for granting the waiver.

“I have determined that the magnitude of the government’s interest in your participation in matters that might affect or involve Goldman Sachs clearly outweighs the concern that your participation may cause a reasonable person to question the integrity of the government’s programs and operations,” Mr. Knight wrote.

Goldman’s Windfall

For investors in the United States and around the world, the days after the A.I.G. rescue were perilous and uncertain; the Dow Jones industrial average fell 4 percent on Sept. 17 as credit markets froze and investors absorbed the implications of the insurance giant’s collapse. That day, Mr. Paulson and his colleagues at the Federal Reserve were scrambling to contain the damage and shore up investor confidence.

But Mr. Paulson has disavowed any involvement in the decision to use taxpayer funds to make Goldman and A.I.G.’s trading partners whole. In his July testimony to the House, he said: “I want you to know that I had no role whatsoever in any of the Fed’s decision regarding payments to any of A.I.G.’s creditors or counterparties.”

Ms. Davis reiterated this, saying that Mr. Paulson’s involvement in the A.I.G. bailout was meant to forestall a collapse of the entire financial system and not to rescue any individual firms exposed to A.I.G., like Goldman. However, she said, federal officials were worried that both Goldman and Morgan Stanley were in danger themselves of failing later in the week and it was in that context that Mr. Paulson received a waiver.

“The waiver was in anticipation of a need to rescue Goldman Sachs,” Ms. Davis said, “not to bail out A.I.G.”

Treasury Department lawyers said a waiver for Mr. Paulson regarding A.I.G. was not necessary, Ms. Davis said, because the A.I.G. rescue was conducted by the Federal Reserve. The Treasury had no power to rescue A.I.G., she said. Only the Fed could make such a loan.

But according to two senior government officials involved in the discussions about an A.I.G. bailout and several other people who attended those meetings and requested anonymity because of confidentiality agreements, the government’s decision to rescue A.I.G was made collectively by Mr. Paulson, officials from the Federal Reserve and other financial regulators in meetings at the New York Fed over the weekend of Sept. 13-14, 2008.

These people said Mr. Paulson played a major role in the A.I.G. rescue discussions over that weekend and that it was well known among the participants that a loan to A.I.G. would be used to pay Goldman and the insurer’s other trading partners.

Over that weekend, according to a former senior government official involved in the discussions, Mr. Paulson said that he had been warned by lawyers for the Treasury Department not to contact Goldman executives directly. But he said Mr. Paulson told him he had disregarded the advice because the “crisis” required action.

Ms. Davis said: “Hank doesn’t recall saying that. Staff had advised that he interact one on one with Goldman as little as possible, not because it would be a violation but for appearances, recognizing someone would likely attempt to read too much into it.”

On Sept. 16, 2008, the day that the government agreed to inject billions into A.I.G., Mr. Paulson personally called Robert B. Willumstad, A.I.G.’s chief executive, and dismissed him. Mr. Paulson’s involvement in the decision to rescue A.I.G. is also supported by an e-mail message sent by Scott G. Alvarez, general counsel at the Federal Reserve Board, to Robert Hoyt, a Treasury legal counsel, that same day.

The subject of the message, acquired under the Freedom of Information Act, is “AIG Letter,” and it contains a reference to a document called “AIG.Paulson.Letter.draft2.09.16.2008.doc.” The letter itself was not released.

Ms. Davis said this letter was intended to confirm that the Treasury and Mr. Paulson supported the loan to A.I.G. and that its officials recognized that any Fed losses would be absorbed by taxpayers. She said the existence of the letter did not confirm that Mr. Paulson was extensively involved in discussions about an A.I.G. bailout.

Since last September, the government’s commitment to A.I.G. has swelled to $173 billion. A recent report from the Government Accountability Office questioned whether taxpayers would ever be repaid the money loaned to what was once the world’s largest insurance company.

Constant Contact

In the ethics agreement that Mr. Paulson signed in 2006, he wrote: “I believe that these steps will ensure that I avoid even the appearance of a conflict of interest in the performance of my duties as Secretary of the Treasury.”

While that agreement barred him from dealing on specific matters involving Goldman, he spoke with Mr. Blankfein at other pivotal moments in the crisis before receiving waivers.

Mr. Paulson’s schedules from 2007 and 2008 show that he spoke with Mr. Blankfein, who was his successor as Goldman’s chief, 26 times before receiving a waiver.

On the morning of Sept. 16, 2008, the day the A.I.G. rescue was announced, Mr. Paulson’s calendars show that he took a call from Mr. Blankfein at 9:40 a.m. Mr. Paulson received the ethics waiver regarding contacts with Goldman between 2:30 and 3 the next afternoon. According to his calendar, he called Mr. Blankfein five times that day. The first call was placed at 9:10 a.m.; the second at 12:15 p.m.; and there were two more calls later that day. That evening, after taking a call from President Bush, Mr. Paulson called Mr. Blankfein again.

When the Treasury secretary reached his office the next day, on Sept. 18, his first call, at 6:55 a.m., went to Mr. Blankfein. That was followed by a call from Mr. Blankfein. All told, from Sept. 16 to Sept. 21, 2008, Mr. Paulson and Mr. Blankfein spoke 24 times.

At the height of the financial crisis, Mr. Paulson spoke far more often with Mr. Blankfein than any other executive, according to entries in his calendars.

The calls between Mr. Paulson and Mr. Blankfein, especially those surrounding the A.I.G. bailout, are disturbing to Samuel L. Hayes, a professor emeritus at Harvard Business School and a consultant in the past for government agencies, including the Treasury Department.

“We don’t know what they talked about,” Mr. Hayes said. “Obviously there was an enormous amount at stake for Goldman in whether or not the A.I.G. contracts would be made whole. So I think the burden is now on Mr. Paulson to demonstrate that there was no exchange of information one way or the other that influenced the ultimate decision of the government to essentially provide a blank check for A.I.G.’s contracts.”

In a letter accompanying the government’s production of Mr. Paulson’s calendar under the Freedom of Information Act request, Kevin M. Downey, a lawyer for Mr. Paulson, raised questions about how comprehensive the schedules were. He noted, for example, that the calendars did not reflect the Treasury secretary’s attendance at several public events. Mr. Downey did not return phone calls or e-mail messages seeking further comment.

Moreover, because the schedules include only phone calls made through Mr. Paulson’s office at Treasury, they provide only a partial picture of his communications. They do not reflect calls he made on his cellphone or from his home telephone.

According to the schedules, Mr. Paulson’s contacts with Mr. Blankfein began even before the height of the crisis last fall. During August 2007, for example, when the market for asset-backed commercial paper was seizing up, Mr. Paulson spoke with Mr. Blankfein 13 times. Mr. Paulson placed 12 of those calls.

By contrast, Mr. Paulson spoke six times that August with Richard S. Fuld Jr. of Lehman, four times with Jamie Dimon of JPMorgan Chase and only twice with John Thain of Merrill Lynch.

U.S. lawmakers seek BofA-Merrill probe

U.S. lawmakers seek BofA-Merrill probe