T H I N K P R O G R E S S

In April, Sen. John McCain (R-AZ) claimed that “you could make an argument that there’s been great progress economically” since President Bush took office. He then revised that argument in August, releasing an ad that declared “we’re worse off than we were four years ago.”

Now McCain is revising his timeline again. In an interview with right-wing radio host Michael Medved this past Friday, McCain agreed with Medved’s assertion that “the economy was really progressing pretty well under most of President Bush’s term” before Democrats took control of Congress in January 2007:

MEDVED: Let me ask you one other thing senator, which again, I think is on the minds of lots and lots of our listeners. The economy was really progressing pretty well under most of President Bush’s term. Then the Democrats took over in Congress in 2007 and now we’re in this horrible crisis. Coincidence?

MCCAIN: No, it isn’t.

McCain went on to place the blame for the financial crisis on Fannie Mae and Freddie Mac, claiming that Democrats “were willing co-conspirators with this game of three-card monty that went on and then it collapsed.” Listen to it here:

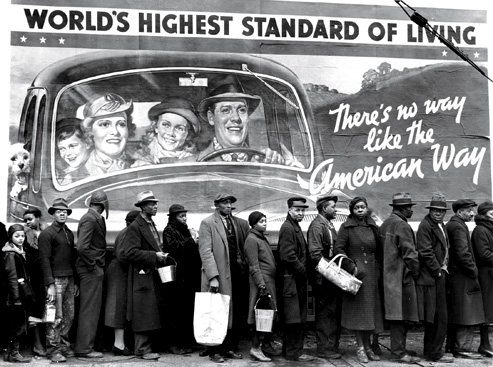

Medved and McCain’s claim that “the economy was progressing really well” before Democrats took control of Congress is laughable. As Center for American Progress Senior Fellow Christian Weller’s economic snapshot from December 2006 shows, the economy was already in rough shape:

Famly Debt Was Rising: By September 2006, household debt rose to an unprecedented 130.9% of disposable income. From March 2001 to September 2006, personal debt relative to disposable income grew each quarter by 1.6 percentage points—almost five times faster than in the 1990s. In the second quarter of 2006, families had to spend 14.4% of their disposable income to service their debt—the largest share since 1980.

The Housing Market Had Slowed: The supply of homes for sale each month averaged 6.9 months of supply for the six months ending in October 2006—the largest supply since 1991.

Savings Had Plummeted: The personal saving rate of -1.3% in the third quarter of 2006 marked the sixth quarter in a row with a negative personal saving rate.

As for McCain’s claim that Fannie Mae and Freddie Mac are the central cause of the current economic crisis, McClatchy thoroughly debunked it over the weekend, writing that “private sector loans, not Fannie or Freddie, triggered crisis.” McClatchy notes that the “weakening of underwriting standards for U.S. subprime mortgages” began in late 2004 while Republicans controlled both the House and the Senate.

Transcript:

MEDVED: Let me ask you one other thing senator, which again, I think is on the minds of lots and lots of our listeners. The economy was really progressing pretty well under most of President Bush’s term. Then the Democrats took over in Congress in 2007 and now we’re in this horrible crisis. Coincidence?

MCCAIN: No, it isn’t. Although, as you know, and you and I have had this discussion in the past, the Bush administration let these spending bills be signed and him not doing what Ronald Reagan used to do and that is veto them, make them famous, and fight against it. But also, more interestingly, 2006, there was a group of us, as a result of an investigation, and I think it was the Inspector General, that said, look, this Fannie Mae and Freddie Mac are completely out of control, if we don’t do something about it, we’re going to have an incredible financial crisis. And we sent a letter about it. We introduced legislation to rein them in and Senator Obama at the time said that these subprime loans were, quote, “a good idea.” And the Democrats in Congress were specifically talking about, the ones who got all the money, were defending, defending, and saying we can’t re-regulations on Fannie and Freddie and were actually encouraging, as you know, people to borrow money that they couldn’t pay back. A fundamental of economics, so they were willing co-conspirators with this game of three-card monty that went on and then it collapsed, you know.