Kathleen Pender

The San Francisco Chronicle

November 26, 2008

The federal government committed an additional $800 billion to two new loan programs on Tuesday, bringing its cumulative commitment to financial rescue initiatives to a staggering $8.5 trillion, according to Bloomberg News.

That sum represents almost 60 percent of the nation’s estimated gross domestic product.

Given the unprecedented size and complexity of these programs and the fact that many have never been tried before, it’s impossible to predict how much they will cost taxpayers. The final cost won’t be known for many years.

The money has been committed to a wide array of programs, including loans and loan guarantees, asset purchases, equity investments in financial companies, tax breaks for banks, help for struggling homeowners and a currency stabilization fund.

Most of the money, about $5.5 trillion, comes from the Federal Reserve, which as an independent entity does not need congressional approval to lend money to banks or, in “unusual and exigent circumstances,” to other financial institutions.

To stimulate lending, the Fed said on Tuesday it will purchase up to $600 billion in mortgage debt issued or backed by Fannie Mae, Freddie Mac and government housing agencies. It also will lend up to $200 billion to holders of securities backed by consumer and small-business loans. All but $20 billion of that $800 billion represents new commitments, a Fed spokeswoman said.

About $1.1 trillion of the $8.5 trillion is coming from the Treasury Department, including $700 billion approved by Congress in dramatic fashion under the Troubled Asset Relief Program.

The rest of the commitments are coming from the Federal Deposit Insurance Corp. and the Federal Housing Administration.

Only about $3.2 trillion of the $8.5 trillion has been tapped so far, according to Bloomberg. Some of it might never be.

Relatively little of the money represents direct outlays of cash with no strings attached, such as the $168 billion in stimulus checks mailed last spring.

Where it’s going

Most of the money is going into loans or loan guarantees, asset purchases or stock investments on which the government could see some return.

“If the economy were to miraculously recover, the taxpayer could make money. That’s not my best guess or even a likely scenario,” but it’s not inconceivable, says Anil Kashyap, a professor at the University of Chicago’s Booth School of Business.

The risk/reward ratio for taxpayers varies greatly from program to program.

For example, the first deal the government made when it bailed out insurance giant AIG had little risk and a lot of potential upside for taxpayers, Kashyap said. “Then it turned out the situation (at AIG) was worse than realized, and the terms were so brutal (to AIG) that we had to renegotiate. Now we have given them a lot more credit on more generous terms.”

Kashyap says the worst deal for taxpayers could be the Citigroup deal announced late Sunday. The government agreed to buy an additional $20 billion in preferred stock and absorb up to $249 billion in losses on troubled assets owned by Citi.

Given that Citigroup’s entire market value on Friday was $20.5 billion, “instead of taking that $20 billion in preferred shares we could have bought the company,” he says.

It’s hard to say how much the overall rescue attempt will add to the annual deficit or the national debt because the government accounts for each program differently.

If the Treasury borrows money to finance a program, that money adds to the federal debt and must eventually be paid off, with interest, says Diane Lim Rogers, chief economist with the Concord Coalition, a nonpartisan group that aims to eliminate federal deficits.

The federal debt held by the public has risen to $6.4 trillion from $5.5 trillion at the end of August. (Total debt, including that owed to Social Security and other government agencies, stands at more than $10 trillion.)

However, a $1 billion increase in the federal debt does not necessarily increase the annual budget deficit by $1 billion because it is expected to be repaid over time, Rogers said.

Annual deficit

A deficit arises when the government’s expenditures exceed its revenues in a particular year. Some estimate that the federal deficit will exceed $1 trillion this fiscal year as a result of the economic slowdown and efforts to revive it.

The Fed’s activities to shore up the financial system do not show up directly on the federal budget, although they can have an impact. The Fed lends money from its own balance sheet or by essentially creating new money. It has been doing both this year.

The problem is, “if you print money all the time, the money becomes worth less,” Rogers says. This usually leads to higher inflation and higher interest rates. The value of the dollar also falls because foreign investors become less willing to invest in the United States.

Today, interest rates are relatively low and the dollar has been mostly strengthening this year because U.S. Treasury securities “are still for the moment a very safe thing to be investing in because the financial market is so unstable,” Rogers said. “Once we stabilize the stock market, people will not be so enamored of clutching onto Treasurys.”

At that point, interest rates and inflation will rise. Increased borrowing by the Treasury will also put upward pressure on interest rates.

Deflation a big concern

Today, however, the Fed is more worried about deflation than inflation and is willing to flood the market with money if necessary to prevent an economic collapse.

Federal Reserve Chairman Ben Bernanke “has ordered the helicopters to get ready,” said Axel Merk, president of Merk Investments. “The helicopters are hovering and the first cash is making it through the seams. Soon, a door may be opened.”

Rogers says her biggest fear is not hyperinflation and the social unrest it could unleash. “I’m more worried about a lot of federal dollars being committed and not having much to show for it. My worst fear is we are leaving our children with a huge debt burden and not much left to pay it back.”

Economic rescue

Key dates in the federal government’s campaign to alleviate the economic crisis.

March 11: The Federal Reserve announces a rescue package to provide up to $200 billion in loans to banks and investment houses and let them put up risky mortgage-backed securities as collateral.

March 16: The Fed provides a $29 billion loan to JPMorgan Chase & Co. as part of its purchase of investment bank Bear Stearns.

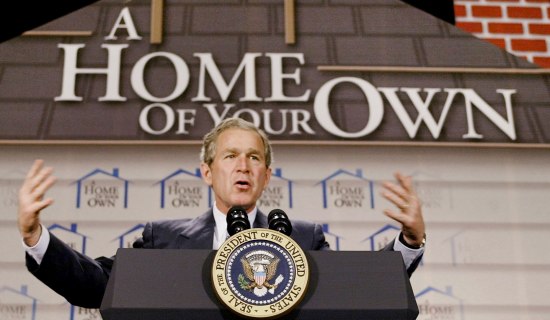

July 30: President Bush signs a housing bill including $300 billion in new loan authority for the government to back cheaper mortgages for troubled homeowners.

Sept. 7: The Treasury takes over mortgage giants Fannie Mae and Freddie Mac, putting them into a conservatorship and pledging up to $200 billion to back their assets.

Sept. 16: The Fed injects $85 billion into the failing American International Group, one of the world’s largest insurance companies.

Sept. 16: The Fed pumps $70 billion more into the nation’s financial system to help ease credit stresses.

Sept. 19: The Treasury temporarily guarantees money market funds against losses up to $50 billion.

Oct. 3: President Bush signs the $700 billion economic bailout package. Treasury Secretary Henry Paulson says the money will be used to buy distressed mortgage-related securities from banks.

Oct. 6: The Fed increases a short-term loan program, saying it is boosting short-term lending to banks to $150 billion.

Oct. 7: The Fed says it will start buying unsecured short-term debt from companies, and says that up to $1.3 trillion of the debt may qualify for the program.

Oct. 8: The Fed agrees to lend AIG $37.8 billion more, bringing total to about $123 billion.

Oct. 14: The Treasury says it will use $250 billion of the $700 billion bailout to inject capital into the banks, with $125 billion provided to nine of the largest.

Oct. 14: The FDIC says it will temporarily guarantee up to a total of $1.4 trillion in loans between banks.

Oct. 21: The Fed says it will provide up to $540 billion in financing to provide liquidity for money market mutual funds.

Nov. 10: The Treasury and Fed replace the two loans provided to AIG with a $150 billion aid package that includes an infusion of $40 billion from the government’s bailout fund.

Nov. 12: Paulson says the government will not buy distressed mortgage-related assets, but instead will concentrate on injecting capital into banks.

Nov. 17: Treasury says it has provided $33.6 billion in capital to another 21 banks. So far, the government has invested $158.6 billion in 30 banks.

Sunday: The Treasury says it will invest $20 billion in Citigroup Inc., on top of $25 billion provided Oct. 14. The Treasury, Fed and FDIC also pledge to backstop large losses Citigroup might absorb on $306 billion in real estate-related assets.

Tuesday: The Fed says it will purchase up to $600 billion more in mortgage-related assets and will lend up to $200 billion to the holders of securities backed by various types of consumer loans.

Source: Associated Press